Deducting Mortgage Interest on a Rental Property.

While there are endless ways to invest your money, a 2019 Gallup poll found that 35% of American respondents say real estate is the best long-term investment option; while 27% say stocks. If you have cash lying around and want to put your money to work, one investment option to consider is an income property.

The tax benefits of rental property ownership can’t be underestimated. In fact, you could argue the tax write-offs for rental property owners are on par with the cash flow generated by the assets themselves. After all, saving is equally as important as making money, if not more so.

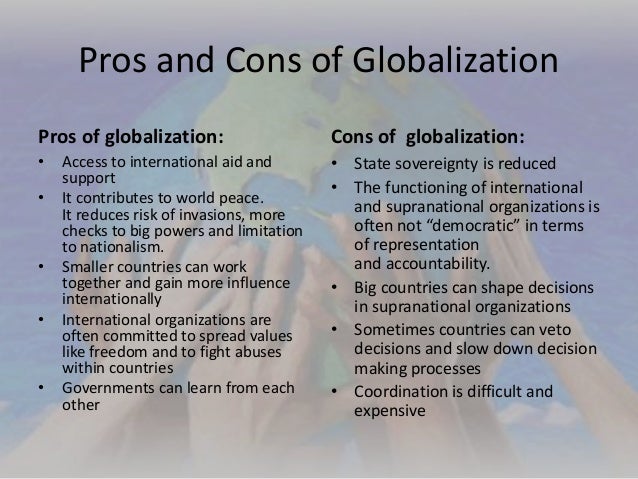

Advantages and Disadvantages of buying an investment property Some people purchase investment properties for tax deductible purposes while the others purchase the properties for more income. The interest charged on investment loan is normally tax deductible.

The key to maximizing tax deductions for vacation homes is keeping annual personal use of your second home to fewer than 15 days or 10% of the total rental days, whichever is greater. In that case the vacation home can be treated as a rental, meaning you get the same generous deductions.

You can avoid this tax hit if your intent is to buy a new rental home immediately after you sell. You do so with an IRS benefit called a 1031 Exchange, which is named after the IRS code number. This allows you to defer paying the capital gains taxes at closing as long as you identify a new rental property to buy (in writing) within 45 days, and close the new purchase within 180 days of.

Residential rental properties. If you invest in a rental property or rent out your current property, you'll need to keep records right from the start, work out what expenses you can claim as deductions, and declare all your rental-related income in your tax return.

Investing in a rental property: the pros and cons There are a number of advantages and disadvantages to buying a property and then renting it out. Talk to an accountant, lawyer, mortgage broker or other financial expert about how it may affect your taxes and financial situation.

Because they fail to take advantage of all the tax deductions available for owners of rental property. Rental real estate provides more tax benefits than almost any other investment. Often, these benefits make the difference between losing money and earning a profit on a rental property.

This is because rental property is passive income for everyone who is not a real estate professional, meaning it won't be subjected to self-employment tax. If your rental is an S corp, you'll need to have payroll, meaning you'll pay Medicare and Social Security taxes.

What Are the Benefits of Owner Occupied Rental Property?. Living in your own rental property carries a lot of advantages. First and foremost, it can help you get your foot in the door to a lucrative career in real estate investment. While buying both a single-family house for yourself and a rental property might be.

The Benefits of Owning International Real Estate. Investing in foreign real estate is a good way to start internationalizing your portfolio and your life, and there are plenty of benefits of owning it aside from just diversifying your assets. In addition to protecting your wealth, buying international real estate also allows you to earn higher returns and enhance your tax strategy, and in.

If you buy a property as a higher or additional rate taxpayer, you will have to pay income tax at 40-45%. However, by putting it through your limited company, you will only be subject to pay corporation tax at 20%. There are other options if you do not want to buy via your limited company. A lower-earning spouse could put the property into.

Investing in a buy to let property can be a profitable way to use your money, but there are downsides you need to consider. Here are the pros and cons of buying a property to rent out. Although house prices have fluctuated in recent years, property is still a relatively safe long term investment. Property prices will go up and down, but over.